Data centers are the backbone of the digital economy, but their energy consumption is rising rapidly. Thousands of data centers worldwide now consume 1.5–2% of global electricity on their own, and this share is projected to nearly double in the coming years due to investments in artificial intelligence. This trend is placing significant pressure on energy infrastructure and sustainability goals.

Number of Data Centers and Global Distribution

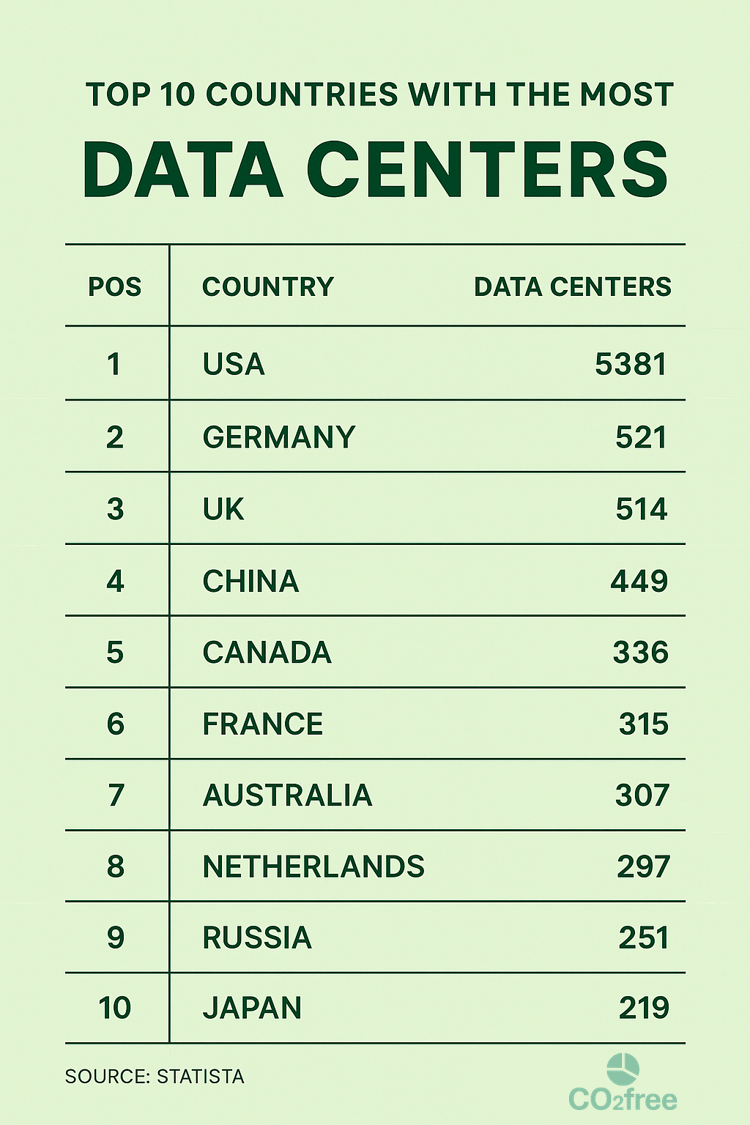

Top 10 countries with the most data centers (as of 2023). The U.S. leads by a wide margin, followed by countries in Europe and Asia.

Worldwide, the number of data centers has reached around 11,800 (as of 2024). Nearly half of these facilities are located in the U.S. – with the U.S. alone hosting over 5,400 data centers, followed by Germany (~529), the U.K. (~523), and China (~449). Geographically, North America accounts for over 40% of global data centers, making it the largest share. Europe also hosts a significant portion (especially in Western Europe), while the Asia-Pacific region is rapidly expanding with markets such as China, Japan, India, and Singapore. In contrast, Africa currently holds a very small slice of the pie (<1% of global capacity), although investments are accelerating there as well.

Energy Consumption: Current State and Scale

The scale of electricity consumption by data centers is now comparable to that of some countries. In 2022, data centers consumed approximately 460 TWh of electricity, equating to about 2% of global electricity use. In other words, the electricity used by all data centers could power roughly 6.5 million homes in the U.S. alone. A single large-scale data center can draw power equivalent to the consumption of tens of thousands of homes. For example, in a small country like Ireland, data centers already account for 17% of electricity demand, and this share is projected to rise to 32% by 2026 – a situation that even led the government to impose a temporary moratorium on new data center projects.

Most of a data center’s power is used to run servers and cooling systems. In a typical data center, about 40% of energy costs go toward cooling and electrical infrastructure. Although efficiency has improved over the years (with cooling and infrastructure-related consumption dropping from 40% in 2014 to 30% in 2023), the total consumption continues to grow. During the 2010s, the industry managed to keep energy consumption stable despite increasing workloads—operations tripled between 2015 and 2019, while annual consumption stayed around ~200 TWh. However, this stable period ended after 2020 with the rise of cloud computing and AI-driven applications that require intensive computation.

Trends in Consumption Growth and Future Projections

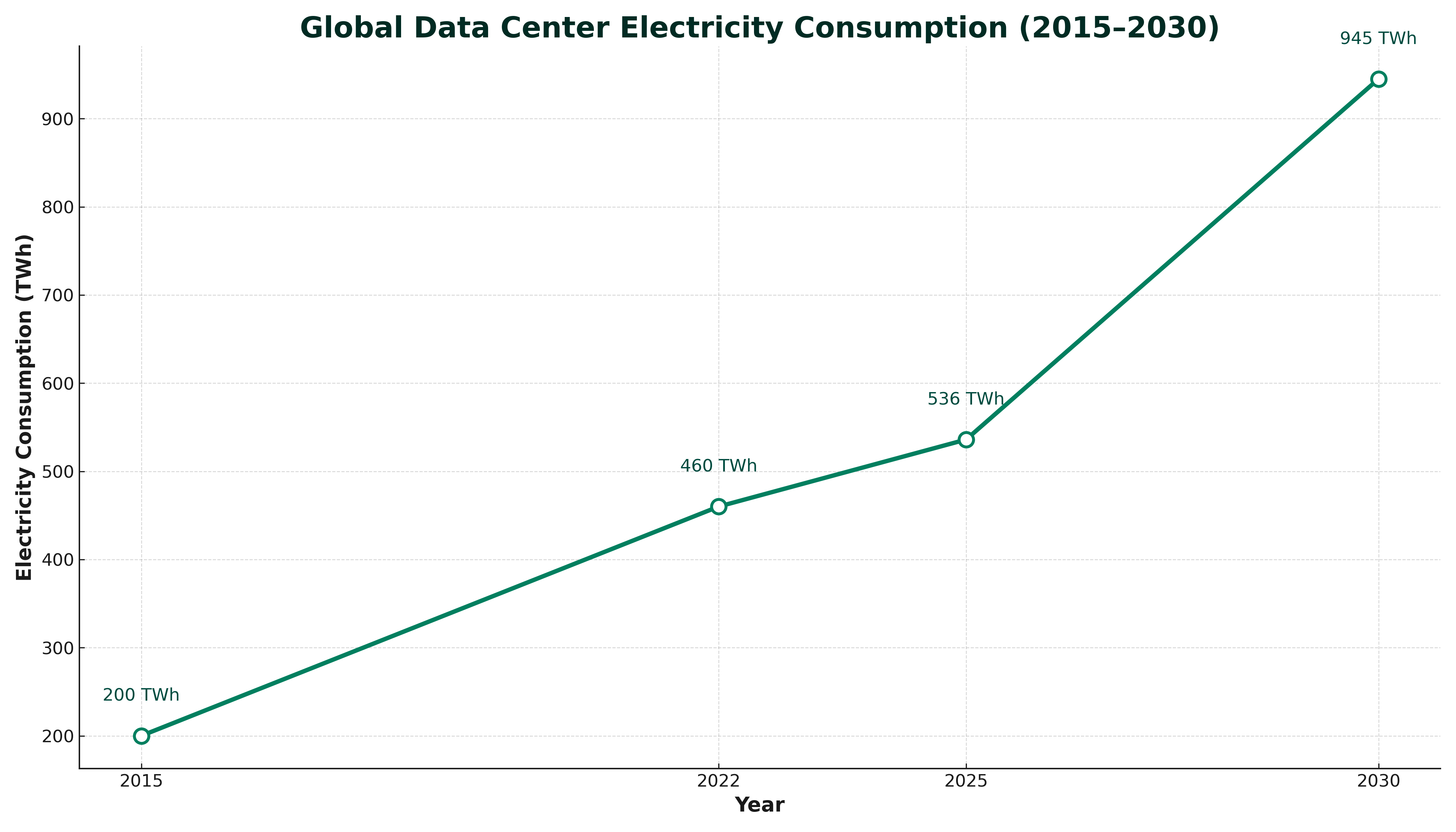

The energy demand of data centers has now entered a new rapid growth phase. Particularly, AI applications and the training/operation of large-scale language models consume much more energy than traditional workloads. For instance, a single ChatGPT query uses about 10 times the electricity of a typical Google search. This shift is expected to significantly raise the sector’s overall power needs in the coming years. According to Goldman Sachs, global data center power demand will increase by 160% between 2022 and 2030, raising the sector’s share of global electricity from 1–2% to 3–4%. The International Energy Agency (IEA) similarly projects that annual consumption, about ~415 TWh in 2024, will reach 945 TWh by 2030. Deloitte forecasts that consumption, estimated at ~536 TWh (2% of global electricity) in 2025, will climb to 1,065 TWh by 2030.

The growth in global data center electricity consumption over time (in TWh). Consumption remained flat from 2015–2019, then rose sharply post-2020 with AI and cloud demand. It is expected to roughly double from 2022 to 2030.

This growth is so significant that between 2022 and 2026, the increase in data center–related electricity demand could range from 650 to 1,050 TWh—equivalent to adding a country the size of Sweden (lower estimate) or Germany (higher estimate) to the global grid. In just a few years, the additional demand will match the total electricity needs of a mid-sized European nation. The current trajectory is moving data centers from the periphery to the center of the energy ecosystem—so much so that some estimates suggest data centers may account for 8% of U.S. electricity demand by 2030 (up from 3% in 2022).

Regional Differences: U.S., Europe, and Asia

- U.S.: The U.S., as the heart of the data center industry, hosts about one-third of the world’s data centers. In 2022, U.S. data centers consumed ~200 TWh of electricity, and this is expected to rise to 260 TWh (6% of national demand) by 2026. By 2030, data centers in the U.S. alone may use nearly one-tenth of the country’s electricity. Northern Virginia (Ashburn) particularly houses the densest cluster of data centers globally, and demand from data centers in the local grid is projected to quadruple over the next 15 years.

- China and Asia: China is rapidly increasing data center consumption, supported by its large domestic market and major tech companies. By 2026, data centers in China are projected to constitute 6% of national electricity demand. The Asia-Pacific region overall is also experiencing massive expansion, with over 13,000 MW of new data center capacity under development. Cities like Beijing, Singapore, Tokyo, and Shanghai rank among the largest global data center hubs. As demand grows, energy strategies become critical—for example, Singapore has introduced new sustainability standards requiring data center operating temperatures to be raised to at least 26°C to reduce cooling loads.

- Europe: Europe hosts about 15% of global data centers. While demand is rising, it is not as steep as in the U.S. or China; nonetheless, between 2023 and 2033, Europe’s electricity demand driven by data centers and electrification could grow by 40–50%. By 2030, consumption by European data centers may equal the combined current usage of Portugal, Greece, and the Netherlands. Consequently, the EU’s September 2022 Energy Efficiency Directive mandates that large data centers implement reporting and efficiency measures starting in 2024. Some cities (e.g., Amsterdam) have even paused new data center constructions to protect urban electrical infrastructure.

- Other Regions: Ireland is a notable case due to foreign tech investments—despite its small population, data centers accounted for 17% of electricity in 2022, expected to reach one-third by 2026, prompting temporary restrictions on new builds for grid security. The Middle East and Africa are still in early stages: investments are growing in South Africa, Nigeria, and Kenya, but these regions’ global share remains very low (<1% for all of Africa).

Energy Strategies of Major Tech Companies

- Google: Since 2017, Google has purchased enough renewable energy to match the annual electricity consumption of its global data centers, achieving 100% renewable energy sourcing. It has set an even more ambitious goal of 24/7 carbon-free energy by 2030, aiming to match every hour of consumption with clean energy at each data center location. Google’s facilities achieve one of the industry’s lowest PUEs (around 1.10) and leverage AI-driven energy optimization systems (e.g., DeepMind for cooling optimization) to cut costs and carbon footprint.

- Microsoft: Microsoft has committed to powering its operations with 100% renewable energy by 2025 and becoming carbon negative by 2030. The company is phasing out diesel generators in data centers in favor of green hydrogen fuel cells and battery storage for backup power. Recognizing that renewables alone may not handle sudden AI-driven load spikes, Microsoft is also exploring carbon capture–enabled natural gas plants as transitional solutions, balancing sustainability and uninterrupted service.

- Amazon (AWS): As the world’s largest cloud provider, Amazon Web Services is investing heavily in clean energy while expanding its data center footprint. Amazon accelerated its target, planning to reach 100% renewable energy by 2025 for all operations, and has invested billions in wind and solar projects. Along with Meta and Google, Amazon ranks among the top corporate purchasers of renewable energy. By 2023, Amazon announced over 500 renewable energy projects totaling more than 20 GW of capacity—enough to power 7 million homes annually.

- Meta (Facebook): Meta has reported that since 2020, it has powered all operations, including data centers, with 100% renewable energy. The company has common agreements for large-scale solar and wind farms in the U.S. to deliver carbon-neutral services for Facebook and Instagram. Meta also uses AI-driven efficiency systems in its data centers to optimize cooling and server usage, with a target of net-zero emissions across its supply chain by 2030.

These tech giants also support industry-wide initiatives for clean energy innovation. For example, Amazon, Google, and Microsoft participate in global efforts to develop small modular nuclear reactors and next-generation geothermal technologies to add 24/7 carbon-free resources to the grid—aiming not only to purchase renewables but also to transform the overall energy ecosystem.

Renewable Energy Use and Efficiency Initiatives

Facing increasing scrutiny, the data center industry is taking significant steps toward renewable energy adoption and efficiency. Globally, 27% of data center electricity consumption is already sourced from renewables (wind, solar, hydro). The IEA expects this to reach 50% by 2030 as massive renewable investments accelerate worldwide. Many new data centers enter into wind and solar PPAs to offset their grid consumption. Utilities serving data centers (e.g., those working with Google and Microsoft) offer specialized green energy tariffs and deals. Additionally, installing solar panels on rooftops and wind turbines on campus grounds is becoming common practice.

On the efficiency front, the industry is innovating across the board. The key metric, PUE (Power Usage Effectiveness), approached an average of 2.0 in the early 2010s but has fallen below 1.2 in many modern facilities. The global average PUE improved from 1.6 in 2014 to ~1.4 in 2023, and is projected to reach 1.15–1.35 by 2028. Lower PUE means less “extra” energy is wasted. For example, Google’s AI-based control systems have cut data center cooling energy by 30–40%. Operators also employ free cooling (outside air), hot/cold aisle containment, and waste heat recovery to minimize HVAC load.

Hardware efficiency improves each generation too: new servers and processors deliver higher performance per watt for the same workload. Specialized chips (ASICs, TPUs) are far more efficient than general-purpose CPUs for targeted tasks. Virtualization and containerization further boost resource utilization, reducing idle energy waste.

As a result of these efforts, although sector-wide energy consumption remained stable through the mid-2010s, the AI-driven surge in recent years has pushed consumption up again. Stakeholders across the industry and governments are collaborating to strengthen grids and green data centers. Some countries integrate data center development with clean energy projects, repurposing idle power plants into campus sites. Pilot programs are capturing waste heat for district heating in certain regions.

Conclusion

As data centers become indispensable in the modern economy, their energy consumption has reached levels that cannot be ignored. Current trends indicate that without urgent measures to reduce the carbon footprint of digitalization, energy infrastructure will be strained and sustainability targets jeopardized. On the positive side, major tech companies and the wider industry are making decisive moves toward renewable energy and efficiency gains. However, the green transformation driven by exponential AI and cloud demand will be more critical than ever in the coming decade. The data center sector must harness innovation and investment to keep growing while staying in harmony with the planet’s energy balance—arguably the defining challenge of the next ten years.